Clyde McPhatter & the Drifters-“Money Honey” (click to listen or download).

Busy, busy time at the Madison Board of Education.

At the Monday, August 10th meetings, in addition to the Talented and Gifted Program Plan, new limitations on the transportation of homeless students, middle school report card evaluation (more linked here), Singapore Math, and much, much else; there are big items involving the Budget Gap created by the State Budget and the use of American Recovery and Reinvestment Act Title I and IDEA funds.

The Budget Gap document is interesting and intriguing, though not terribly detailed. For those who need a reminder of the situation the district finds itself in, here is how Supt. Dan Nerad describes their circumstances:

The amount of revenue the district is projected to lose amounts to $2,810,851 for the 2009-10 school year compared to the preliminary budget approved by the board of education. This amount is due to the decrease in numerous categorical aids the school district receives annually and the reduction of the per pupil increase from $275 per child to $200 per child.

The amount of state aid the school district is projected to lose is in 2009-10 is approximately $9.2 million. Under current revenue limit laws, for every dollar of state aid lost, the school district would have the ability to increase taxes by that same amount. Over the past month, administration has worked to mitigate the tax impact due to the loss in state aid.

There are two documents attached as initial recommendations to the Board for discussion. The first is described as utilizing “four specific budget areas to apply a decrease in funding without a reduction or elimination of programs and services.” There are only three listed.

These three are the fund for contingencies and re-budgeting the Elementary Teacher and substitute projections “based on historical” reviews and analyses (I’d like to see these!). These adjustments total $2,810,851.

This all seems good. The re-budgets are related to issues around the Fund Balance and “Salary Savings.” It gets a little complicated, but I think it is worth at least sketching (if you aren’t interested in a little history, please skip down because there is important current stuff below).

“Salary Savings” is an accounting concept that some entities use (some abuse it too). It is based on the reality that allocations for staff are often unfilled — temporarily or permanently — or filled at costs below the allocation. A classic example is when a teacher goes on leave. If for some portion of that period a substitute is employed, the difference between the salary and benefits of the teacher and the substitute would be a (salary) savings. Many public entities budget salary savings at between 1% and 2% of their personnel budgets.

In the minds of some, MMSD abused Salary Savings for a few years. In order to limit programmatic cuts they used unrealistic projections. This led to spending down the Fund Balance.

As the 2007-8 budget was being prepared and considered the district fell under the sway of a fiscal conservative over-reaction. Salary Savings had recently been budgeted in the range of $5 million to $7 million (if I remember correctly) and the reality had been about $2 million or $3 million less (again, if I remember correctly…the figures might be off, but the trends are right). The Fund Balance was shrinking and some Board members were making political hay on this.

When the initial 2007-8 budget was prepared, Salary Savings were projected at $1 million. You may remember that budget. The 2007-8 fiscal year was the year that MMSD almost closed schools; did decimate locally funded class size reductions, did reconfigure special education; did initiate the Athletic Director mess; did reduce allocations for psychologists, social workers, reading specialists and English Language Learning; did eliminate yellow buses for Wright and Spring Harbor, did initiate the private school busing mess.

That budget produced a Fund 10 surplus of $4.3 million. The 2008-9 budget also under-budgeted Salary Savings and a surplus is anticipated.

Another way of phrasing this is that these budgets over budgeted salaries and benefits. That is the way Asst. Supt. Erik Kass likes to think of it.

Erik Kass doesn’t like the concept of salary savings and is working toward more accurate initial allocations. That’s the basis of these re-budgets. The history is why I think it is sound policy.

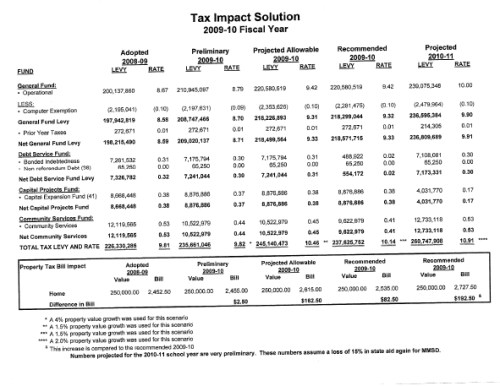

The third part is the “Tax Impact Solution,” and I am not 100% clear on how to read this, but can at least point out some things. Below is an unclear image file, click here for the full document pdf.

The biggest news here is that MMSD is proposing not to tax to their maximum revenue limit in 2009-10. Of $245,140,473 in taxing authority, MMSD proposes to use $237,625, 752; they have authority to increase projected taxes on a $250,000 home by $162.50 and the proposal is to raise taxes on that home by $82.50 (this is from all funds).

As Governor Jim Doyle and others continue to pretend that the revenue limits are all that is wrong with school funding in Wisconsin and pass budgets and propound schemes (and here) that shift more of the burden for educational investments to local property taxes, the fact that a prosperous district in a community with a track record of valuing education does not have the political will to tax to the limit is hard evidence that the problems go well beyond the revenue limits and require a comprehensive solution. New Berlin and Appleton are among the other districts that are not taxing to the max. This is a trend I will be posting on in the future.

Technically, MMSD is proposing to tax to the max with the Fund 10/General Fund and is cutting the taxation for debt service and for Fund 80/Community Services. I believe this is related to state laws that take away revenue authority if it is not used in consecutive years. The way they are doing things should provide more flexibility to not tax to the max in 2010-11.

Whatever happens with the 2010-11 budget/tax decisions, things will be ugly that year and the year following. The projections in this document are for a $110 tax increase on a $250,000 home in 2010-11. The pressure against that increase will be high. 2010-11 will also bring more cuts in categorical aids, as well as more cuts due to the structural gap between allowed revenues and costs. 2011-12 will bring the end of stimulus funding. The maintenance referendum runs out some time in here too. Repeat after me: “We need comprehensive school finance reform.” Send that message to the powers that be.

The document is not clear on how the debt service will be paid. My guess is that the Fund Balance will be used.

The second part of the document promises “no reductions in programs or services,” but the third part reduces the projected levy for Fund 10 from the preliminary budget by $900,00 (the preliminary budget had reduced that levy by $1.5 million already and used the Fund 10 Fund Balance to make up most or all of that amount). There may be some cuts here, or there may be more use of Fund Balances.

Stay tuned for more as things develop.

This post is titled “part 1”; part 2 will be on the ARRA plans. I don’t know when I will get to that. Here is a link to the document. For now, a few highlights/observations based on a first read:

- Proposals for these monies include some 4 Year-Old Kindergarten start up costs, some Ready, Set, Goals costs in Title I schools that may not be within the guidelines. Communication with DPI is ongoing.

- Culturally Relevant programming/development/staffing is included.

- Dual-Immersion implementation is included.

- There is some parent/community outreach development funding.

- Millions in technology purchases are included .

- This money will go away in two years!

- Some of the needs addressed will not go away.

- This will mean that cuts must be found here or elsewhere.

- We need comprehensive school finance reform.

Thomas J. Mertz

Nice to see it in writing that actual money figures are being proposed to help Leopold and Lincoln because of their SIFI status. Since this proposal, it seems, has not been approved yet, I’m surprised the Leopold/Lincoln money is included – considering that those areas have to be in place by the start of the school year (in a few short weeks!) – as is required by federal law! As a parent of two Leopold children, it will be interesting to see what is REALLY done when school starts to get that school off of the list.