The dbs – “Ups and Downs” (click to listen or download)

The dbs – “Ups and Downs” (click to listen or download)

This story — “Bonduel school taxes going down: Increase in state aid one of reasons,” by Lee Pulaski in today’s Shawano Leader made me think of Richard Farina’s novel Been Down So Long it Looks Like Up to Me. That’s what has been going on with school funding in Wisconsin and around the nation, the cuts have been so regular and difficult that any relief, no matter how small, appears like forward movement. The reality, — in the Bonduel district, in Wisconsin and in most of the United States — is that these small steps forward don’t come close to making up for the giant steps backward of the last few years. The editorial board of the Wisconsin State Journal, Senator Scott Fitzgerald and others seize upon these small and local steps, but we can’t let their anecdotes distract from the big picture. Wisconsin Sate Senator John Lehman has promised to convene the Senate Education Committee to “to examine how these 1.6 billion dollar cuts have hurt Wisconsin Schools.” That’s’ a good start, but more is needed. We need more than examination, we need workable plans to fund our schools at a level and in a manner that puts the needs of our students first (see more on this below, at the bottom. Update: The agenda for the hearing is out — August 31 is the date — and it looks like they’ll just be documenting the destruction and previewing future damage.). The tools — if, as you should, you include in the tools the massive cuts in state aid to education which are central to the Fitzwalker game plan– aren’t working to provide students with the Opportunities to Learn that they deserve.

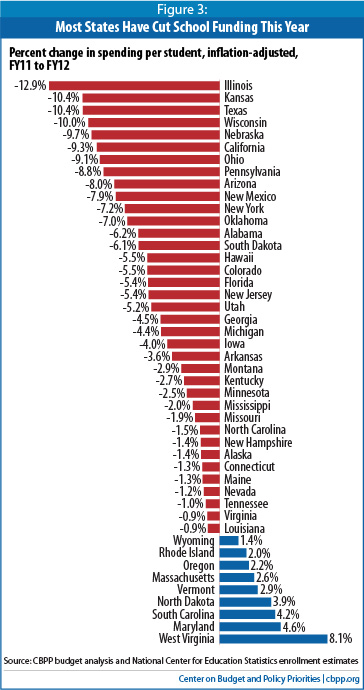

For the national scene see “New School Year Brings Steep Cuts in State Funding for Schools,” By Phil Oliff and Michael Leachman of the Center on Budget and Policy Priorities. Here is one graph from that report.

Notice Wisconsin is the fourth worst state in this chart. That may improve this year because of a one-time $50 per pupil aid. But according to the July aid estimates from DPI, only 155 districts in Wisconsin can expect an increase in state aid the coming year, while 267 will see a decrease. Bonduel is one of the lucky ones. That’s what seems to be at the center of today’s story (it appears that they took a big hit last year and thatrevenues from 4K are kicking in too, like in Madison).

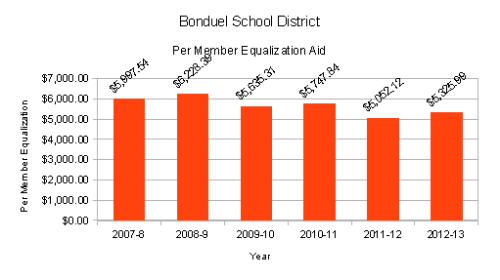

Peter Behnke, the district’s administrator, gushed good news for the taxpayers, who can expect a 3.3 percent decrease in their school property taxes due to an estimated $250,000 increase in state aid, to about $5.6 million.

“State aid is actually increasing for the first time in years, and that’s always a good thing,” Behnke said.

But what is missing is that the aid doesn’t come close to restoring state funding levels to what they were three years ago and leaves state aid per member for 2012-13 an estimated $671.55 belowwhat it was in 2007-08 (and in fact aid increased in both 2009-10 and 2010-11).

Here are some charts. Note that the Bonduel district budget information is not accessible on the district website, charts were prepared using information from the Department of Public Instruction and the Legislative Fiscal Bureau, found here, here, here, here, here, here, and here. For the 2012-13 per member, the 2011-12 membership was used to estimate.

The first is total state equalization aid to Bonduel.

That anyone familiar with this history can “gush” over the 2012-13 projections is evidence of how far down we have been pushed.

We need to push back, up and out of this hole.. State Superintendent Tony Evers’ Fair Funding for Our Future is a start, but it won’t be enough unless it includes an influx of new state revenues. That’s one reason why I think something like Penny for Kids is more necessary now than ever. Penny for Kids would provide about $850,000 annually in new revenues for our schools. I also think that Penny for Kids inclusion of a real aid to schools educating students in poverty is essential to addressing the gaps in achievement that plague our state and district (Fair Funding includes increased state aid to districts based on student poverty, but no new money or taxing authority only property tax relief, so this will supplant, not supplement).

After all the slings and arrows, the cuts, the failed recall, the still slow economy…I know many are like the District Administrator in Bonduel, ready to accept minor improvements as cause for celebration. I think we can’t let down look like up, we have to keep our eyes on the prize, keep on pushing, not forget what is right just because it seems out-of-reach. I hope Senator Lehman shares that attitude when he convenes his Committee, I hope he remembers the ideals of the Pope-Roberts Beske Resolution (he was a signatory). Here they are as a reminder:

1. Funding levels based on the actual cost of what is needed to provide children with a sound education and to operate effective schools and classrooms rather than based on arbitrary per pupil spending levels;

2. State resources sufficient to satisfy state and federal mandates and to prepare all children, regardless of their circumstances, for citizenship and for post−secondary education, employment, or service to their country;

3. Additional resources and flexibility sufficient to meet special circumstances, including student circumstances such as non−English speaking students and students from low−income households, and district circumstances such as large geographic size, low population density, low family income, and significant changes in enrollment;

4. A combination of state funds and a reduced level of local property taxes, derived and distributed in a manner that treats all taxpayers equitably regardless of local property wealth and income…

These are still things worth working for. Just thinking about them lifts me up.

Thomas J. Mertz