The Dolly Mixture — “Spend Your Wishes” (click to listen or download).

With all the appropriate attention given this weekend to the opportunity to re-engage in collective bargaining (if you haven’t weighed in the Board, there is still time: board@madison.k12.wi.us) another and very important item on the Madison Metropolitan Board of Education’s agendas for Monday, September 24 2012 has slipped somewhat under the radar. I’m talking about the Administrative Recommendations related to the unanticipated state aid, involving $8.1 M in taxing/spending. Matt DeFour has a story up at the State Journal, but I haven’t heard much from anyone else on this (except some chatter that I solicited on my Facebook page).

First some general observations then to the specifics of the recommendations.

General Observations

The timeline is too tight.

The district has till the end of October to finalize their 2012-13 budget; the recommendations were made public Friday (9/21) and the Board is being asked to give “preliminary approval” to these recommendations on Monday. An earlier document said the recommendations would be presented to a committee on September 17. They were not (see about the 90 minute mark and note Ed Hughes asks if they will be asked to act on 9/24 and is told “no,” but never-the-less they are being asked to act…hmm). I understand that these are somewhat special circumstances, but think the spirit of the statutorily mandated open budget process with required timely public disclosures and formal opportunities for public comment should be honored as much as possible. A preliminary approval on Monday would be about as far from that as you could get. Use the time available to give careful consideration and to allow the public to give consideration also.

The Board Member Amendments and other things considered during the regular budget process — including unfunded portions of the Achievement Gaps Plans — do not seem to have been given special consideration.

You could argue that these have been considered and rejected (back in July Ed Hughes made a related case here and here more recently), but I would counter that those rejections were based in part on tax levy considerations that have changed. I would further argue that revisiting things is more respectful of the spirit of an open budget process than is bringing in “new” items this late in the game. They also probably could be dealt with relatively fast. I have a particular fondness for the amendment Maya Cole put forth on Library staffing and think it should come back; others may want to reconsider parts of the Gaps Plans or other things. I think these should be the starting point.

Five votes are needed to do anything.

Once the Preliminary Budget is passed, changes need a super majority.

The pie hasn’t grown any larger, only the mix of where the ingredients are coming from has changed.

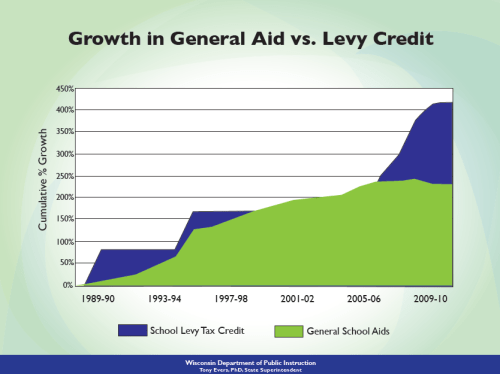

The Revenue Limit for MMSD — what I’m calling “the pie” — is the same as it had been in June, but more state aid means less local property taxes. All the potential revenues contemplated in the Recommendations have been there since the start of the budget process. It was a choice not to use them. Many factors — including “efficiencies” (good and bad), significant cuts in state aid, and the 2008 referendum have made the levy limits almost irrelevant in Madison budget talks recently. This is not the case in most districts, may not be the case in MMSD in the future, and in terms of state policy Rev Caps remain a big problem.

The calculations around minimizing tax levies seem to be changing, but I’m not sure how.

As noted above and (indirectly in the documents from the district), the Preliminary Budget for 2012-13 (like the 2010-11 and the 2011-12 budgets) was arrived at by giving great weight to the size of the tax levy, and (as I’ve argued here and elsewhere) perhaps not enough weight to the needs of the students (and no consideration of the way the levy credits shape the impact of the levy on taxpayers). The administrative recommendations return to the days of “taxing to the max.” This doesn’t seem to be a change in the principles used, but rather a one time move, based on the fact that a levy higher than anything possible at this point has already been found acceptable. It should also be noted that the administration isn’t presenting options for taxing to the max, the default for saying no to the recommended expenditures is to reduce taxes (as a general thing, not just budgets, I really think the role of the administration is to present a range of options and their analyses of these options). What is clear from the recommendations (contingency allocations, IRTs, Assistant Principals — and other things like the hiring of a Chief of Staff and the reorganization of the Equity/Parent Involvement Department — is that some of the efficiencies enacted in pursuit of lower taxes during the Nerad years have not been good for the district. There is a lesson here.

Budgets are about choices; Choosing the items recommended by the administration means not choosing other things.

Basic, but a reminder is is always good. The Rev Caps do limit the size of the pie and you can only get so many slices out of it. If you are funding iPads, you aren’t funding Librarians with that money (or raises, or repairs, or software, or social workers, or smaller classes, paying off loans, or tax relief….). Current choices also shape or limit future choices, money committed to an ongoing expense this year won’t be there next year for anything, including the staff raises that almost all Board Members seem interested in exploring. $8.1 million in choices to be made.

The Recommendations (mostly in order with comments and initial — mostly tentative — opinions)

Requirements (headings from the Recommendations)

Property Tax Relief (state revenue limits), $3,700,000

This is required by the Rev Caps. As noted above, the default to more tax relief is problematic. It should also be noted that this is listed as being the same for the following year, when we really have no idea at all what the Rev Caps or the state aid will be.

WRS Increase, $1,200,000

Not really required, but seems like a good idea.

Short Term for Long Term Good/Closing Gaps

Second Year of Achievement Gap Plan, $3,700,000 (in 2013-14)

If I read this correctly, this recommendation is to hold off taxing this amount this year, in order to fund Achievement Gap(s) Plan (AGP) initiatives next year. Again, this assumes some things about what the state will do with the next budget. It also kind of assumes that after a year the initial results or other considerations will warrant continuing or expanding initiatives. Last it sort of commits the Board to this. I say “sort of” because the there really isn’t a separate pot of money (or revenue authority) being created and come 2013-14 Budget the Board (in office at that time…three seats up in April 2013) can do whatever they want with a majority vote.

My feeling has always been that if there are things that there are good reason to believe will have a significant positive impact on a significant number of students, and we have the revenue authority to fund these, we should, now, not later (I know the “significants” raise other questions). This late in the game, finding good ways to spend $3.7oo,000 may be hard, but I think it is worth a try. If ideas are lacking at this time, the levy could be approved and a process could be put in place to generate and vet initiatives for the Spring semester (or the Summer). This of course could create lots of confusion and uncertainty, so maybe the best thing to do would be to pay off some loans early and/or fund maintenance/capital improvements this year with the authority. Those would free up money in future budgets.

4K from DPI Grant, $624,186 (in 2013-14)

This is another set aside for the next budget. Some related things here. Similar comments as above, except that the “need” for the funded items in 2013-14 is more certain.

Technology – iPads, $1,580,000 and (under “Closing Gaps“) iPad Coach, $74,927 (and $77,924 2013-14 and what looks like an ongoing expenditure)

Side note — this looks like an assumption of the generic teacher FTE allocation cost increasing by $2997 or 4% next year).

I don’t like these recommendations.

Larry Cuban (who has written extensively and insightful on technology and education) has asked “”What is the pressing or important problem to which an iPad is the solution?” I don’t think the answer from the administration justifies the expenditure:

Provide one to one use of iPads for teachers. Using iPads can make the work of teaching more effective, more efficient, and more rewarding. Our teachers will have one of the best tools to improve instruction, communicate with students and colleagues, develop or adopt digital learning tools and manage their classroom. If we recognize the teaching staff can benefit in these ways using this technology we make a bold statement to our staff and our community. (emphasis added)

I tend to be skeptical of both “bold statements” and handheld technologies in education. A couple of teacher friends saw some good in this, the one that was more convincing to me was a gym teacher who saw a means to do attendance and assessments while still engaged with students.

That seems like a good use, but the question remains are there enough “pressing or important problems” to justify buying this many more iPads? I was told the district has 1,500 now; all I could find was this purchase of 586 in January 2012 and the Technology Acquisition Plan to purchase 900 in 2011 (this document is the fullest explanation of the vision for iPads in the district there is also an iPad page for the District, and the MMSD 2009-2013 Information (Library Media) & Technology Plan: Draft).

I’m not 100% sure how many the District has now or who has them. At $500 per, the recommended purchase would bring the total to at least 3,500 and maybe to 4,500. There are about 2,700 teachers (including social workers, counselors, psychologists). So while I have come to see a place for iPads, I don’t see a place for that many and think the allocation procedure described in plan to purchase 900 should work to get the iPads in the hands of those who will make good use.

Some other people have weighed in with me on the iPads, bringing up issues of support 9that go beyond coaching), choice of hardware (iPads are not the only or necessarily the best tablets, only the ones that make the boldest statement), obsolescence, the top-down nature of this initiative, and pulling teachers away from active engagement during class time. All good points that reinforce my inclination to urge a “not now” vote.

Interim Chief of Staff Funding, $100,000

The recommendation says the money is currently coming from Title I. That isn’t what was said at the time it was approved. I think Steve Hartley brings many good things to the position and is an asset, but I still don’t like the way this went down and the funding confusion only adds to this. Back on the levy, fine. I’ll add that as the Superintendent search and hire goes forward, in the light of this and the whole rereorganization of the Nerad reorganization, there should be an attempt at clarity of Doyle organization, expenses and positions, especially at the “Cabinet Level.”

Technology – Wireless $650,000

All reports are that the current wi fi is overloaded. This seems like a good capital expenditure.

Closing Gaps

2.0 Teacher Leaders, $149,854 (for 2013-14, $155,848)

Here’s the explanation:

The AGP recommended 1 Elementary Teacher Leader for on-going support of Elementary Instructional Resource Teachers (supporting the implementation of Mondo) and 1 Secondary Teacher Leader as a member of the School Support Team for high schools to increase fidelity of literacy across the content areas/disciplinary literacy and English. We are recommending the restoration of these positions as critical to the literacy focus for our students.

You want to give initiatives a good shot at working and I mostly support this. My only problem is with the designation for Mondo. Last year Mondo was piloted and the results weren’t good (and here) yet the Board voted to expand. Now it looks like additional funding and a two-year commitment is being asked for. This looks like doubling down on doubling down. There should be a do-or-die moment for Mondo as part of the next budget cycle.

Assistant Principal and Clerical, $156,940 (and $163,218 in 2013-14).

More leftovers from Nerad’s penny wise and pound foolish reorganizations. This looks OK. One note, the explanation indicates hat 550 pupils is now the tipping point for adding Assistant Principals. I believe it used to be 500. When did this change? Was the Board aware? This is like class size, a creeping erosion of quality done quietly. It also should be noted that these expenditures were never part of the AGP and should be assumed to be ongoing expenditures.

Math Teachers .93, $69,682 (and $72,469 for 2013-14)

This seems to be to support Sch0ols of Hope (btw — when are we going to see a real evaluation and cost out of Schools of Hope?). The job description is strange, especially the last line:

.93 FTE Teacher Allocation: The HS math interventionist will work with math staff to identify appropriate students, provide PD and assistance to the tutor coordinator and tutors, analyze assessments via Renaissance Learning (we already are using this but not to its full potential) and communicate with math teachers. A big plus is that the Math Interventionist will be able to generate a roster of students in IC, this has been a huge barrier for the community partners.

Generating a roster hasn’t been possible and we need a highly skilled interventionist to do this? Still, I support (but I do want that cost out and evaluation, if student and staff time are being spent with Schools of Hope and it isn’t helping much, that is important to know). Assumed to be ongoing.

Security Assistant (3), $132,731 ($138,187 for 2013-14)

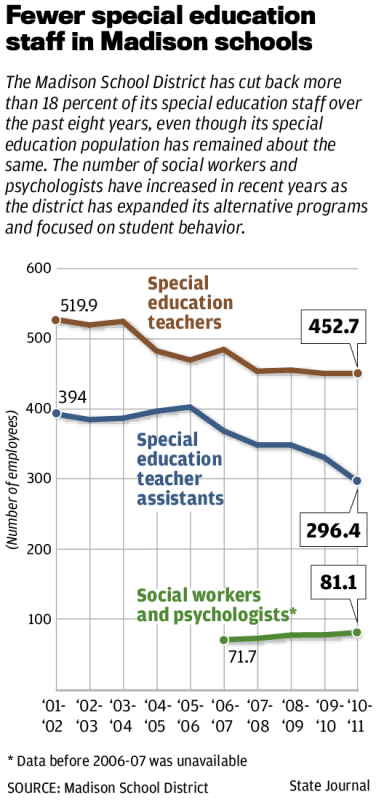

There were no additional allocations for Security Assistants in any of the iterations of the AGP, so how this ended up being listed as part of Closing Gaps is a mystery. It is also indicative of something I’ve observed before with MMSD and (in the world at large) and that is treating social problems as policing problems. In fact, if you read the explanation it comes out something like, “Our Principals are too busy doing educational work to deal with discipline issues, so let’s throw some paraprofessional security assistants into the mix.” I’d be much happier if the recommendation was to throw more social workers and psychologists into the mix. I fairness, there are some references to size of schools and mix of programs as a justification, but I’d like to know more in detail about what the needs are and how the security assistants are expected to help. Without that, I say spend some of the set asides and get the social workers. Assume to be ongoing.

High School REAL Grant Coordinators (nothing in 2012-13, $155,848 in 20114).

These have been grant funded and the grants are going away. I don’t object to the allocations at this time, but do think that this presents an opportunity to reassess the work and job descriptions before extending via other funding. Assumed to be ongoing.

Secondary Unallocated 5.0, $374,635 (and $389,620 in 2013-14)

I strongly support this and perhaps an increase in Elementary Unallocated (the recommendation isn’t clear on the needs there, but lacking any good data from the district anecdotal reports of bigger class sizes in the last few years incline me to believe there may be a need) . The cuts to these have limited the flexibility, created closed sections and larger classes. They should not have been cut as deeply as they were and restoring is a good idea. Assumed to be ongoing.

PBS Coaches, (nothing in 2012-13 and $498,714 in 2013-14)

Positive Behavior Support is a very good idea and a good program. It should be funded for every school. Assumed to be ongoing.

Seed to Table $74,927 (and $77,924 in 2013-14)

This was presented at a Committee meeting recently. It seems like a good program. Assumed to be ongoing.

Final Thoughts

As I said, most of these opinions on the individual items are tentative. There simply has not been time for anyone to reach firm, grounded conclusions.

The process is another matter. I’m firm and grounded in my opinion that both the Board and the public should be given more time before decisions are requested. I’m firm and grounded in my opinion that more options should be presented, including things suggested but not funded during the Preliminary Budget work. Last, I’m firm and grounded in my opinion that leaving levy authority unused under these circumstances is a mistake and at very least ask that Board consider early loan payments. maintenance needs and capital improvements as possible one-time expenditures, rather than under-levying.

Thomas J. Mertz