Wisconsin State Superintendent of Public Instruction Tony Evers has released a “framework for school funding reform” called “Fair Funding for Our Future” (press release here, DPI page here). I’m glad that Evers is showing some leadership and it looks like it may be a good framework, but with so few details it is hard to tell.

Wisconsin State Superintendent of Public Instruction Tony Evers has released a “framework for school funding reform” called “Fair Funding for Our Future” (press release here, DPI page here). I’m glad that Evers is showing some leadership and it looks like it may be a good framework, but with so few details it is hard to tell.

The one thing I like best is the stated goal of “a fresh look at school funding and to ensure[ing]that candidates for elected office address school finance in real and substantial terms in their campaigns this fall.” Evers clearly understands the need for reform and that if legislators and the Gubernatorial candidates don’t make commitments during their campaigns there is no chance that they will take positive action once in office (he probably also understands that even with campaign commitments there is no guarantee).

The lack of detail works fine for this purpose (lots of detail would work too). Still, I do think it is worth spending a little time looking at what is and isn’t there and how filling in the specifics could move this in good and bad directions.

Here are the bullet points (there is very little but bullet points):

Creates a Fair and Sustainable School Funding System that:

- Prioritizes funding for ALL students.

Provide a minimum level of state aid for every student in Wisconsin, regardless of where they live.- Accounts for family income and poverty.

Use student poverty – not just property value – as a factor in a portion of state aid to schools.- Provides predictable growth in state support for schools.

Increase state school aids and local revenue limits by a predictable percentage each year.- Supports rural schools.

Expand sparsity aid and transportation funding.Brings Transparency and Accountability for Results to School Funding by:

- Ensuring state education dollars are spent educating children.

Allocate the nearly $900 million School Levy Tax Credit into general school aids – a move that does not increase net property taxes statewide, but ensures that significant state financial assistance goes to kids and classrooms.- Investing in innovation and programs that show results.

Consolidate and target categorical aids in ways that encourage innovation and focus on increasing student achievement, turning around struggling schools, and improving graduation outcomes.- Protecting Wisconsin students and taxpayers.

Ensure that no school district faces a drastic reduction in state school aid in any given year.

Before looking at these each in turn it is important to remember that all these moving parts interact and that this is especially important if the total investments are not increased or are increased only minimally. If the same sized pie is being sliced differently there will likely be winners and losers. The levy credit move kind of increases the state’s contribution to the pie (or at least moves the state’s contribution from tax relief to education) but doesn’t increase the size of the total funding pie.

Prioritizes funding for ALL students.

Provide a minimum level of state aid for every student in Wisconsin, regardless of where they live.

The first sounds good but is pretty meaningless; the second really depends on what the minimum is. Under the current system there is a $1,000 per pupil minimum called Primary Equalization aid.

Accounts for family income and poverty.

Use student poverty – not just property value – as a factor in a portion of state aid to schools.

This could be a big change, depending on the weights given to income and property wealth and depending on whether “family income” for the district as a whole is used or “student poverty” is the measure. [ Added 8:50 AM, 6-25-10: From the press conference reports it is clear that student poverty would be used. I’m keeping the discussion of using district income because it helps illustrate the complexity of assessing changes to the system] Madison is a high property wealth, high income district with high student poverty. Last session there was proposed legislation to move to a solely district income based equalization formula, which according to this LFB analysis would have resulted in an over 60% 68% loss in aid for MMSD. In contrast, one based on on student poverty should help MMSD significantly (I haven’t seen anyone run the numbers).

Just a little background on this. For years the big push to incorporate income in equalization has come from high property wealth districts with many vacation homes but relatively low incomes among year round residents (sometimes called the Lake Districts). Others, including the Wisconsin Alliance for Excellent Schools and the School Finance Network have concentrated more on including student poverty either in a foundation formula or as a categorical aid. Further complicating things is the possibility that in some of the Lake Districts, the relatively low incomes might not translate fully into high student poverty as measured by free and reduced lunch counts (and the under-counting of poverty by that measure, especially with secondary students, is always a factor too). Many moving parts.

Provides predictable growth in state support for schools.

Increase state school aids and local revenue limits by a predictable percentage each year.

Predictable is good. But like the 2/3 state funding commitment (however calculated — see the levy credit stuff below), what the legislature gives, the legislature can take away.

I’m also intrigued by the “predictable percentage each year” phrasing. Any growth based on income measures, educational costs, cost-of-living…wouldn’t be predictable. This instead sounds like a call for a guaranteed minimum percent. If that’s the case, what the percent is and how it relates to costs are the big questions.

Supports rural schools.

Expand sparsity aid and transportation funding.

As a superintendent I know in a struggling, small rural district has been quoting lately “show me the money.” Inadequate sparsity aid (such as that in place the last few years) only relives a little pressure. Without some real fixes we will see districts dissolve in the next couple of years. Taken as a whole, the reforms Evers proposes may stop that from happening, or they may not (too few details, too many moving parts to tell). I hope they do.

Ensuring state education dollars are spent educating children.

Allocate the nearly $900 million School Levy Tax Credit into general school aids – a move that does not increase net property taxes statewide, but ensures that significant state financial assistance goes to kids and classrooms.

For background on this read Professor Andrew Reschovky’s important paper, “A Critical Review of Property Tax Relief in Wisconsin: The School Levy Credit and the First Dollar Credit.”

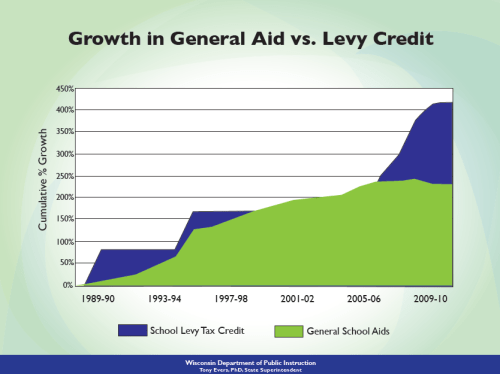

If you read the press release or look at the charts posted by DPI (such as the one below), this appears to the centerpiece of the Framework.

Note the steep increase in the last two state budgets. As I’ve said before, this gives lie to the assertions by state lawmakers that it is difficult to change the school funding system; these represent significant changes and were easily accomplished. Few people noticed (Evers was pretty much silent on this and other school funding matters during the last budget period).

Note the steep increase in the last two state budgets. As I’ve said before, this gives lie to the assertions by state lawmakers that it is difficult to change the school funding system; these represent significant changes and were easily accomplished. Few people noticed (Evers was pretty much silent on this and other school funding matters during the last budget period).

This was so far off the radar that even districts like Madison that benefited from the change did not include the benefits in their budget discussions or explanations (I tried to get them to and if they had figured in the recent credits of about 1.5% for most taxpayers, this may have given them the courage to not under-levy so extremely).

As policy it is kind of a no-brainer that money called education aid should go to education and not tax relief, but that hasn’t been the case in Wisconsin because tax credits were counted as part of the 2/3 funding when that % was statutorily required and continue to be counted as such in most calculations (including the maintenance of effort calculations in the ARRA and Race to the Top paperwork it is worth noting). So I like the policy change of using “education funding” to fund education.

It is also a no-brainer that state education tax relief should not be skewed to the most wealthy districts or individuals. This is what the levy credit did.

How this money should be distributed is more complicated.

A good case can be made to reallocate to an expanded Homestead Credit and stop calling it education aid. I’m not going to make that case here, but it is worth thinking about.

Evers is committed to using this as part of a revamped equalization formula. I think this is in part because it looks like “free money,” in that it allows him to ask to put more state money into schools without asking for new revenue sources via tax reform or something like Penny for Kids. It is worth noting that with many districts under-levying (like Madison) what looks like a lot more money statewide might not end up being that much more money locally (or any more money at all) if when the impact of losing the tax credits is understood districts react by passing levies well below the authorized amount. A couple of people also pointed out to me that in districts with higher property wealth (and maybe others) this will make passing referenda harder.

[Added 5:15 PM, 6-24-10] Note that Evers’ plan says no “net” increase in property taxes. Higher value property owners and higher value districts will see increases or at least the districts will see levy authority to increase if they choose. Lower value owners and districts will see decreases. What this does is increase the Robin Hood factor of equalization. Good in theory, but the primary, secondary and tertiary aid formulas as they now exist (also in theory) take into account some level tax relief via credits. The formulas also assume something like 2/3 state funding, so maybe none of this matters because they have essentially been junked anyway). Whatever matters or doesn’t in theory, this change if done in isolation would necessitate sizable property tax increases in Madison (in 2008-9 the levy credits totaled $1,636 per student for Madison, some of this would be offset by the increase in the equalization pool and one would hope a student poverty factor).

How this and everything else plays out depend on all the pieces and how they fit together. The biggest piece here is the incorporation of some poverty measure in the equalization calculations.

Investing in innovation and programs that show results.

Consolidate and target categorical aids in ways that encourage innovation and focus on increasing student achievement, turning around struggling schools, and improving graduation outcomes.

Buzz, buzz, buzz. Buzzwords. All good, but what these innovations are and how results are assessed matter.

On categorical aids, I’m a bit confused by the desire to consolidate and the related decision to push for poverty as a factor in equalization instead of as a new categorical. I can appreciate the desire to streamline and simplify, but unless you go to a Foundation plan the Wisconsin school funding system will remain a Rube Goldberg machine.

I prefer a Foundation plan, but if that isn’t going to happen, I think more and better categoricals are the best way to get resources where they are most needed and will do the most good. I get skeptical about proposals that are based the idea that you can better target by using fewer tools to aim.

Protecting Wisconsin students and taxpayers.

Ensure that no school district faces a drastic reduction in state school aid in any given year.

Sounds good, but again depends on what “drastic” means. Right now the figure is a 15% cut (btw see Ed Hughes’ post today on why that 15% cap on cuts is important when funding is decreasing). Obviously there has to be some “hold harmless” for any reform proposal to be viable. Others I’ve seen are literally “hold harmless,” it worries me that even as a Framework this one is “hold from drastic harm.”

Maybe I worry too much. As more details are put forward we’ll find out if I’m being chicken little. I hope I am. I hope that this all fits together in a way that puts our state back on track. I know that is what Superintendent Evers wants too. I certainly share and support that desire and appreciate his efforts.

Some links:

School Finance Network reaction.

Tom Barrett, Scott Walker, and Mark Neumann responses.

Thomas J. Mertz

Thanks for this important and worthy analysis. Let’s hope that WAES and SFN lead in the critical effort to sustain schools in their hour of need, and pressure the leaders to follow.

It is of interest that in all of this discussion there remains no long term, viable option for shoring up our state and our societies most important investment. For years, Greens including myself have been calling for progressive taxation, for a constitutional amendment (at a federal level, where it matters most) that would include funding the schools in an unprecedented manner. It is interesting to note that the current Superintendent saw fit to threaten to revoke tens of millions of dollars from the poorest schools of the state, in effect carrying water for the federal government, yet seems not to want to push for a more comprehensive solution, now months if not years since several school districts were hemorrhaging.

Well we can only keep pushing for real education reform; while not holding my breath on this one, I’ll remain cautiously optimistic that the students, parents, teachers, the principals, the teachers union and the great advocacy organizations WAES and SFN among others have finally gotten the attention of the State leaders. Perhaps if funding reform does come through, the MPS teachers can get their shoes back . . . (see recent “Stepping UP” rally) http://www.youtube.com/watch?v=FOgKWvr2HbE

I am responding to Tony Evers comment about the charter and private school teachers should also be held responsible for the outcome of the childrens education. I would like to take it one step further – What about all of the families that say that they are home schooling and aren’t. They don’t have to answer to anyone. I know this for a fact. I know 3 boys that if they were tested at their grade level in the subjects that they are supposed to be learning that they wouldn’t even come close. I get the feeling that they can’t even sign their names. I am a retired teacher and very aware that theses boys have not been taught. They are relatives so I can’t do anything about it without being kicked out of the family. I believe that there should be a check and balance with home-schooled children too.