I’ve been known to chide Wisconsin’s lawmakers for their reluctance to enact or even talk about essential revenue reforms. It is only fair to note when they do the right thing and the good they’ve done by doing the right thing.

Yesterday the Legislative Fiscal Bureau released the April 2010 tax collection data. Two big pieces of good news here. First, collections are only down 1% from last year and that means that there will be no need for a budget reconciliation and the cuts to shared revenues and state services it would surely bring. Second, corporate taxes are up by 32.4% over last year.

Too many moving pieces and not enough info to know in much detail, but the closing of the Las Vegas loophole by enacting Combined Reporting in the last biennial budget certainly contributed to this. A very positive step in returning some balance to our revenue system and staving off further cuts to essential investments and services. Good work.

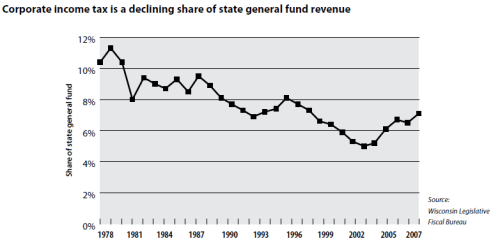

As the chart at the top indicates, there is still more work to do. There are other loopholes to close, and other places to look at the balance among taxes paid in Wisconsin. As always, the Institute for Wisconsin’s Future/Wisconsin Council on Children and Families Catalog of Tax Reform Options for Wisconsin. is the place to start (these organizations also deserve much of the credit for pushing lawmakers on Combined Reporting).

In a related story, Democratic Gubernatorial candidate Tom “No New Taxes (for now)” Barrett is not getting suckered into abandoning Combined Reporting because of ignorant attacks from those vying for the GOP and Tea Party mantle(s) (and here)..

On the national front, The Cap Times has a good follow up to the sales tax for education (read Penny for Kids) vote in Arizona, with your intrepid blogger offering some thoughts. This also came up in the WORT diiscussi0n of school finance (listen here and try to make the WORT Block Party this Sunday ). Also of note is the lawsuit over school funding in California and the continued need to advocate for the Harkin Education jobs proposal.

Above, I said there is still work to do. It isn’t only because to the previous trends in corporate taxation it is because Wisconsin’s revenue and school finance systems are broken, and till they are fixed school cuts will continue all around the state. Here are some recent examples:

Five Marshfield teachers cut to balance district’s budget

Manitowoc School Board OKs teacher, aide layoffs

36 teachers will receive layoff notices

Teachers under fire as districts deal with tight budgets

Budget, teacher cuts create turmoil for districts in area

School district bankruptcies seen as possible

Much more work to do. Get started!.

Thomas J. Mertz