After over a decade of of advocacy and effort, district-wide Four-Year-Old Kindergarten starts in the Madison Metropolitan School District this morning.

After over a decade of of advocacy and effort, district-wide Four-Year-Old Kindergarten starts in the Madison Metropolitan School District this morning.

Thank you and congratulations to all who made this happen.

Thomas J. Mertz

After over a decade of of advocacy and effort, district-wide Four-Year-Old Kindergarten starts in the Madison Metropolitan School District this morning.

After over a decade of of advocacy and effort, district-wide Four-Year-Old Kindergarten starts in the Madison Metropolitan School District this morning.

Thank you and congratulations to all who made this happen.

Thomas J. Mertz

Filed under Best Practices, Elections, Equity, Local News

The Staple Singers -“Long Walk To D.C” (click to listen or download)

The Staple Singers -“Long Walk To D.C” (click to listen or download)

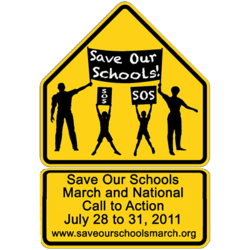

Yes, it is a long walk to D.C. and many of us who care deeply about the future of public education will not be able to join the Save Our Schools mass action there from July 28 to 3o. Instead, some of us will be rallying in Madison. Join us and help spread the word (download flier here and press release here).

Wisconsin Public School Advocates to Rally at the Capitol, Saturday July 30, 3:00 PM

“A need for national, state, and local action”

As hundreds of thousands of public school supporters gather in Washington DC the weekend of July 28 to 30, 2011, Wisconsin advocates will hold a rally in support of the Save Our Schools agenda at 3:00 PM on Saturday July 30, near the State St. entrance to the Capitol.

“Public schools are under attack. There is a need for national, state, and local action in support of our schools. Wisconsin has been ground zero in this; the Save Our Schools demands from the Guiding Principles provide a great framework to build our state movement and work to expand opportunities to learn” said education activist Thomas J. Mertz.

The Save Our Schools demands are:

Equitable funding for all public school communities

An end to high stakes testing used for the purpose of student, teacher, and school evaluation

Teacher, family and community leadership in forming public education policies

Curriculum developed for and by local school communities

Doing more with less doesn’t work. “The time to act is now. While phony debates revolve around debt ceilings, students and teachers across the country are shortchanged. We need real reform, starting with finally fixing the school funding formula, and putting families and communities first. What child and what teacher don’t deserve an excellent school?” said rally organizer Todd Price, former Green Party Candidate for Department of Public Instruction and Professor of Teacher Education National Louis University.

The event will feature speeches from educators, students, parents and officials, as well as opportunities for school advocates from throughout Wisconsin to connect and organize around issues of importance in their communities.

For more information, visit: http://www.saveourschoolsmarch.org/ and http://saveourschoolswisconsin.wordpress.com/

Thomas J. Mertz

I was struck by the relationship between two things in recent Wisconsin State Journal stories. The first of these is the graph above illustrating the cuts of over 150 Special Education staff positions (from Matt DeFour’s report on the new MMSD Middle School Mental Health initiative). The second was this quote from Board President James Howard in Defour’s story on greater than anticipated cuts in state aid to the Madison Metropolitan School District:

School Board President James Howard said the board’s goal has been to not raise property taxes and, “I think that’s still our position.”

The short version of my reaction is that if your goal is hold the line on taxes, then I guess you are just fine with cutting programs and services, even those that serve the most vulnerable as Special Education does. I’m not OK with that prioritization and am not OK with a Board and Board President who are. The longer version — including an analysis of how the 2008 referendum fits with this — follows.

[Note, as I was finishing this Board Member Ed Hughes put up a post indicating that he is more open to a property tax increase than president Howard and offering readers an opportunity to weigh in via a pollu. When you are done here, read that post and vote).

Where to start? I’ll begin with the obvious truth there are things that MMSD schools should be doing, ways they could be helping students, but are not and that these things cost money. As a consequence of inadequate funding (among other things), MMSD is failing provide appropriate educational opportunities and services for some students and excellent opportunities and services for many. In other words, budget cuts impact education. If you don’t believe the above, you should probably stop reading now.

The cuts to Special Education staff are one example (note I was cognizant of the 2006 cross-categorical teacher drop due to a change in case load allocations for “Speech and Language Only” students, the cuts to SEAs are somewhat surprising to me). It is also worth noting that the approved Preliminary 2011-12 Budget appears to cut a further $3,231,626 from Education Services, the department in charge of Special Education, ELL and more (this figure may have changed slightly due to amendments, I’m using the initial Budget because the “approved Preliminary….” isn’t on line). If any of these cuts come from Special Education, the district may be in danger of losing Federal Funding due to the Maintenance of Effort requirements of IDEA which as explained in this memo from DPI do not recognize “savings from reduced staff benefits as exceptions.”

Special Education is just one area where more resources would help; there are many others. It should also not be forgotten that this preliminary — no new taxes — budget was balanced by cutting staff compensation, as Board Member Ed Hughes has said “underpaying our most important employees… a false economy.”

Now on to Board Goals. I looked at in vain at the statues governing Boards of Education, at the MMSD Policies, at the District Philosophy, at the Mission Statement, at the Strategic Plan for any reference that could support not raising property taxes as a goal superior to providing the best possible education for the students in their charge.

You can look too, you won’t find it. What you will find is much that calls for the Board to (in the phrase from the Strategic Plan) “vigorously pursue the resources necessary to achieve our mission,” the mission being:

…to cultivate the potential in every student to thrive as a global citizen by inspiring a love of learning and civic engagement, by challenging and supporting every student to achieve academic excellence, and by embracing the full richness and diversity of our community.

The last couple of MMSD budgets have each left about $10 million in revenue authority unused; the approved Preliminary Budget leaves (I believe) about $9 million (again, no final preliminary is on line, so I’m estimating). It would not have taken, and does not now take much vigor to access these resources. It may take a little courage.

I realize that much has changed in the last few years — widespread economic hardship, cuts in state aid by both Democratic and Republican state governments, much slower than anticipated growth in property values, , the opportunity to cut staff compensation under the threat of union busting, dramatic cuts to the revenue limit base — but despite all of these changes, if you go back to the principles and the details of Partnership Plan used to sell the 2008 Operating Referendum (which passed overwhelmingly) I think you can find plenty of justification for increasing property taxes in order to achieve the mission of the district. Maybe not to the fully allowed limit (maybe) , but certainly beyond the level the Board President has stated as a goal.

That referendum is the primary reason why even with the FitzWalker mandated 5.5% cut in allowed revenue, Madison has the ability to maintain and even expand opportunities. In more ways than one, that’s what over 68% of the voters agreed to. They did not vote to freeze property taxes, they voted to raise them.

The strongest Partnership Plan based case for using the entire $10 million in referendum granted authority this year and every year is that that plan anticipated only a three year total of $9 million in cuts from cost to continue budgets, a total that was about doubled in the combined actual budgets of the first two years.

To me that is compelling, but some Board Members and others will point out the plan anticipated higher state aid and growth in property values than have been realized, and that these factors — along with general economic conditions — justify cutting at a higher level, I don’t agree, but for the sake of argument I’m willing to stipulate that rather than relying on the “cuts from cost-to-continue ” metric, we should also look at the total property tax burden.

Looking at the total levy instead of the total cuts is one way to deal with the diminished state aid and the lack of growth in property wealth to produce a conservative estimate of the tax burden agreed to by voters who ratified the Partnership Plan . However if you are going to elevate property taxes over other considerations in this manner it is only right to fully account for changes in property taxes and that includes dealing with the School Levy Credits.

As explained by Andy Reschovsky, the Levy Credits are categorized by the state as school aid but in fact function as property tax relief misdirected toward wealthier districts and property owners. Shifting the almost $900 million a year allocated to the Levy Credits into general state school aids is a centerpiece of State Superintendent Tony Evers Fair Funding for the Future proposal.

Since 2006 the Levy Credits has almost doubled. For the most part this has been ignored by School Boards in their Levy and Budget deliberations. I think that was because districts almost always taxed to the max under revenue limits, so there was little reason to look at how the Credits impacted the net taxes of property owners. One place where this would have made sense was in the otherwise detailed discussions of referendum related tax increases, but — despite my advice at the time — MMSD did not include the Levy Credits in their presentations for 2008 referendum.

Since 2009-10 MMSD has ceased taxing to the max and has begun making minimizing tax burdens the top or near top consideration, the “goal.” That means that the Levy Credits need to be part of the discussion, because as Reshovsky explains MMSD taxpayers benefit greatly from the Credits:

Using Madison as an exam-ple, in 2009, the average gross school mill rate was 9.79. The city’s school levy credit allocation resulted in a 1.76 mill rate reduction. Tax bills were then calculated using the net school mill rate of 8.03. Thus, the School levy credit resulted in a $352 tax saving for the owner of property worth $200,000 (.00176 times $200,000), and a tax saving of $880 for the owner of a $500,000 property.

For the purposes of this comparison of the levies anticipated in the Partnership Plan and the actual/preliminary levies for the period covering the 2009-10 through 2011-12 budgets, what is most important is that while cutting general school aids for the years 2009-10 and 2010-11, the Democrats increased the Levy Credits and that the Republicans in power have maintained these increases. At the time voters approved the 2008 referendum, the Levy Credits for MMSD totaled 37,198,954. For 2009-10 this increased to 40,934,795 and for 2010-11 they were 40,304,862. I haven’t seen estimates for 2011-12, but the total funding for the Levy Credits is unchanged and it seems safe to assume that the share going to MMSD taxpayers will be about the same.

The table below uses projected property tax totals from the Partnership Plan, the actual levies for the first two years and the levy from the approved preliminary budget for 2011-12. To account for the Levy Credits I’ve subtracted the Levy Credit increases over 2008 (3,735,841 for 2009-10 and 3,105,908 for 2010-11) from the levy totals (using the 2010-11 figure for 2011-12).

According to these figures, MMSD could levy an additional $7,174,422 and still be within a conservative interpretation of the tax increases the voters approved with the 2008 referendum. I think they should use at least this amount of their levy authority to advance their mission.

In the will of the voters as expressed in the referendum vote, I find no evidence that the community shares Board President Howard’s stated goal to not raise property taxes and here and elsewhere I find much that supports reasonable tax increases.

Thomas J. Mertz

I’ve written about Sarah Archibald before. She joined the state payroll when Jim Doyle tapped her to head up Wisconsin’s misguided and failed Race to the Top application, a key element of which was rushed legislation opening the door to the misuse of standardized test scores in teacher evaluations. Now she is doing education policy for the FitzWalker gang as part of Senator Luther Olsen’s staff, busting unions, paving the way for privatization via vouchers, enabling charter school expansion, undermining local control, creating bigger class sizes in our public schools, eroding the opportunities to learn for most of the children of our state, and yes, further expanding the abuse of standardized test-based data to determine the conditions of employment for educators (via the pending SB 95 and AB 130). You can read more about Archibald’s belief in the “need” to include “student test scores” in evaluating and determining compensation for teachers in this piece of Bradley Foundation funded pseudo scholarship.

I’ve written about Sarah Archibald before. She joined the state payroll when Jim Doyle tapped her to head up Wisconsin’s misguided and failed Race to the Top application, a key element of which was rushed legislation opening the door to the misuse of standardized test scores in teacher evaluations. Now she is doing education policy for the FitzWalker gang as part of Senator Luther Olsen’s staff, busting unions, paving the way for privatization via vouchers, enabling charter school expansion, undermining local control, creating bigger class sizes in our public schools, eroding the opportunities to learn for most of the children of our state, and yes, further expanding the abuse of standardized test-based data to determine the conditions of employment for educators (via the pending SB 95 and AB 130). You can read more about Archibald’s belief in the “need” to include “student test scores” in evaluating and determining compensation for teachers in this piece of Bradley Foundation funded pseudo scholarship.

We have a pretty good idea of what Dr. Archibald wants for your children and mine (a little more on that below), but what about her’s? She sends her kids to Wingra School in Madison, where the tuition is $12,000 a year, the teacher student ratio is 12/1, the philosophy is “progressive,” and they don’t believe in tests, standardized or otherwise. I’ll let Doctor Archibald explain in her own words:

…[W]hy we send our kids to Wingra school. At this school, teachers have the luxury of really recognizing and reinforcing each child. With no scripted curriculum and no standardized tests, teachers can focus on allowing the child to blossom and following the kids’ lead in terms of what they want to learn about. Who knows if they’ll really be prepared for high school or college, but they are held, and that counts for a lot.

I can’t help but close with this oft-quoted passage from John Dewey:

“What the best and wisest parent wants for his own child, that must the community want for all of its children. Any other ideal for our schools is narrow and unlovely; acted upon, it destroys our democracy ” (The School and Society, 1899).

Sarah Archibald is a wise parent who is working to destroy our democracy. I think she’s earned the Hypocrite of the Day Award.

Thomas J. Mertz

I came across a short video earlier this week on the WTTW site. It appears the video is set not to repost or download, so go to the link to view it. Really, take the time.

It is an excerpt from a longer documentary on school desegregation in my home town, Evanston, Illinois. I’m going to be working to find the whole show. Evanston was one of the early sites for “affirmative desegregation,” done to overcome def facto segregation and not under legal compulsion. I was part of the first Headstart and Kindergarten classes to integrate Foster School, featured in the video. That’s my kindergarten teacher, Mrs Todd (this must be the afternoon class, because I’m not there and neither are my classmates) and Robin Moran (interviewed) was a family friend.

The desegregation/integration in Evanston was done largely via a Magnet School plan and there were and are problems. To read more about the history, see this write-up of a session on the topic I did some years ago for the History of Education Society and this series from the Evanston RoundTable and this from the Chicago Reporter and check out ShoreFront (these take you up to about 2002, the Roundtable Archives are a good way to catch up from there).

In case you were wondering, that’s where I come from, geographical, ideologically and educationally.

Thomas J. Mertz

Filed under AMPS, Best Practices, education, Equity, Uncategorized

On July 12 the voters in the 48th Assembly District — covering the East side of Madison, Monona, McFarland and the Town of Dunn (map here)– will choose a Representative to the State Assembly to replace now County Executive Joe Parisi. The candidates are (alphabetical, linked to their web sites): Fred Arnold, Dave de Felice, Andy Heidt, Katherine Kocs, Bethany Ordaz, Vicky Selkowe, and Chris Taylor.

I don’t live in the District, but like all progressives in the state, I have a stake in the race. Whoever is elected will be in a “safe seat” which means that they have the opportunity to do more than be a consistent vote; they can push the envelope by introducing and promoting significant progressive legislation, the kind of legislation that makes overly cautious party leaders uncomfortable. With the Republicans in charge, the rhetoric from the Democrats has been heartening, but it should not be forgotten that when they controlled the state from 2008-10 they did nothing to reform school funding except cut $300 million and raise the levy credit, did nothing on the minimum wage, failed to pass the Green Jobs bill, didn’t finish the Union contracts when they could, did much to little in progressive revenue reform…the list goes on. In this race I think people should look beyond opposing Walker to what kind of legislator the candidates will be when the Democrats are in control.There is no shortage in the legislature of “pragmatic progressives” who can find 1,000 reasons not to do the right things; there is a dire need for courageous leaders who will be steadfast in their advocacy both behind caucus doors and in public. Andy Heidt will be that kind of leader, that’s why he has my endorsement and why I’ve been helping with his campaign.

To back up this assertion (and as a service to AMPS readers and voters in the 48th), I’m offering a series of posts examining what the candidates have and have not said about education issues, especially the core issue of school finance, and to a lesser extent the related issues of revenue reform (based primarily on their websites and on internet searches). In the interest of disclosure, I’ll note that I’m acquainted with three of the candidates and believe I have met at least three others and that some things that I know about them or impressions that have not appeared in campaign statements or biographies are part of the analysis. If anyone, including the campaigns has anything to add or dispute, please use the comments to bring it to my attention. This time the order is from who I consider the strongest to who I consider the weakest (Andy Heidt, Vicky Selkowe, , Bethany Ordaz, Fred Arnold Chris Taylor, Katherine Kocs and Dave de Felice — this may change as I do more research).

Andy Heidt

By my criteria, Andy Heidt is far and a way the best candidate. Throughout his campaign — beginning with his announcement (covered here by John Nichols) — he has done more than decry the actions of the GOP, he’s offered positive policy alternatives and pointed to the failure of other Democrats to enact these and other positive proposals. As Nichols put it:

Heidt’s argument that we must do more than merely prevent Walker from implementing his agenda. We must recognize that the crisis Walker is exploiting has its roots in the failure of Republican and Democratic administrations and legislators to recognize that Wisconsin cannot maintain services and public education if our politicians keep giving away tax breaks to multinational corporations and the wealthy.

Nowhere has this been clearer (or in my head more important) than in his statements on education funding. Heidt has issued one press release a “Keeping the Promise” plan (and here, scroll down) for school finance reform ((I helped draft the plan) and a short video.

In the press release, Heidt recognizes the importance of education and shows a “can do” spirit:

There are no more important investments than those we make in our children. They are the future and each generation has an obligation to provide the next with the skills and knowledge they need to be successful. With a fair revenue system, there is no reason we cannot return to the Wisconsin tradition of supporting quality public education.

He also notes past cuts to education under the Democrats and the inadequacy of their recent counter-proposal to the Republican decimation of our schools. No other candidate has been explicit on this.

More importantly, no other candidate has offered anything like the detailed “Keeping the Promise” plan, nor the pledges to action contained in that plan.

“Keeping the Promise” has two parts. First it calls for “immediate action” to address the crises created by 18 years under a broken system, significant cuts in state funding in the 2009-11 budget and the recent Republican measures. These include enacting the Wisconsin Alliance for Excellent Schools Penny for Kids proposal, expanding sales taxes, shifting the levy credits to the equalization formula, rolling back vouchers, fully funding SAGE, allowing for growth of the revenue limits based on CPI or the state GDP, taking the profit motive out of virtual schooling and reinstating educator union rights. The second part build on this by initiating comprehensive reform based on “based on the shared principles of the WAES Adequacy Plan the School Finance Network Plan and the 2007-2008 Assembly Joint Resolution 35.” These are (from AJR 35):

Heidt vows to “work tirelessly” to see that this reform is achieved prior to the next biennial budget cycle.

The sad history of AJR 35 (see here for AMPS posts covering that history)demonstrates the need for someone like Heidt in the Assembly. When the resolution was introduced, the Democrats controlled the Senate and the Governorship, but not the Assembly. Over 60 legislators signed on and the promise of comprehensive school funding reform was part of the 2008 campaign to “Take Back the Assembly.” The Democrats did take back the Assembly and once they did AJR 35 and school funding reform disappeared. Gone. Silence. When some of us who wanted them to keep their promises spoke up, we were told to be quiet because speaking or acting on this difficult issue might jeopardize their electoral prospects in November 2010. I for one didn’t keep quiet, but I’m not taking the blame for the electoral failures of 2010. Instead I’ll offer an alternative analysis — it isn’t the people like me who called for action who are to blame, it is the legislators who didn’t act and didn’t want to be reminded of their failure to act (I said much the same well before the November 2010 elections). Many of those silent, silencing and inactive legislators are now supporting other candidates who share their priorities and outlook in the race for the 48th. I’m supporting Andy Heidt.

[Note — I originally conceived this as one long post, covering all the candidates, but that didn’t work out, so I’m doing a series. This is #1 of 7. — TJM]

Thomas J. Mertz

As the voucher movement in Wisconsin is poised to claim at least a partial victory, at an American Enterprise sessi0n ironically titled “School Voucher Programs and the Effects of a Little Healthy Competition” pro-voucher think tanker Grover Whitehurst inadvertently identified a flaw at the heart of the market-obsessed, school privatization with public money movement. Education Week reports:

He offered an analogy. A school district decides to allow students to buy meals from off-campus businesses, like the nearby McDonald’s. Public school cafeteria directors have several options to keep students eating in house, Whitehurst said, such as trying to improve outreach to students and encouraging the cafeteria staff to be friendlier. The cafeteria director, he said, “knows about the production function for satisfying customers.”

Just as choice in food consumption has not — in the aggregate — resulted in good and healthy choices, choice in education has not and will not result in good and healthy choices. Many people either don’t know or don’t want what is good and healthy. They want what is fast, tasty and popular. The market doesn’t produce results that are healthy for society.

I don’t care much how people spend their food dollars, but I do care how we spend tax dollars and education dollars. I don’t want it spent on the educational equivalent of McDonalds.

Thomas J. Mertz

Phony Democratic Primary Candidates are apparently only the beginning, the GOP has now moved on to insincere revenue legislation.

First term Republican Representative Kathy Bernier is circulating phony legislation proposing an income tax check-off to fund shared revenue, medical assistance, and K-12 education.

In the plea for co-sponsors Bernier explains her “thinking”:

Over the last few months, and years, we have heard certain portions of the population advocate for raising taxes as a means to fund these programs. This gives those people that feel they have the ability to pay more in taxes to do so without mandating that burden on those who cannot afford it.

Cute, huh? Not.

At a listening session back in April, things got ugly for Bernier. On that occasion and probably others, people told Bernier to increase taxes (in April there were also loud complaints about corporate tax breaks).

Voluntary check-offs are not taxes. Taxation involves legal obligations and the power to enforce those obligations. For all the lovers of the US Constitution and the historically minded, one of the biggest reasons that the founding generation replaced the Articles of Confederation was because that document did not include the power to tax, only to ask for voluntary donations from the states. The distinction is important.

While on the topic of distinctions that are lost on Rep. Bernier, the LRB lists “the endangered resources program. .. a veterans trust fund, prostate cancer research, multiple sclerosis programs, a fire fighters memorial, Second Harvest food banks, and a breast cancer research program, and to provide a donation to a professional football stadium district” as items that currently receive fund via check-offs. As worthy as these might be, they are hardly the kind of Constitutionally mandated or essential programs as shared revenue, medical assistance, and K-12 education.

Rep. Bernier and her fellow partisans should stop playing games, stop trying to be cute and get to work on real revenue reform that includes real tax increases. Penny for Kids would be a great start. After that, there are plenty of ideas in the Institute for Wisconsin’s Future’s updated Catalog of Tax Reform Options for Wisconsin. Not cute either, but what the state needs.

Thomas J. Mertz

No, AMPS isn’t taking advertisements, I just wanted to point out how ridiculous the idea expressed in this one is. And note it isn’t just the Iowa Assessments, MMSD has bought the ACT/EPASS/EXPLORE program based on the same pitch.

No, AMPS isn’t taking advertisements, I just wanted to point out how ridiculous the idea expressed in this one is. And note it isn’t just the Iowa Assessments, MMSD has bought the ACT/EPASS/EXPLORE program based on the same pitch.

” College and Career Readiness” as “revealed” by standardized tests starting in 6th grade. Is this the end of education in that goal and yard stick are test based ” College and Career Readiness”? If so then it is the end of education for citizenship and full and rich life.

Caveat — I know that some good can come from monitoring where students are in relation to where they will/should be going.

Thomas J. Mertz

Filed under Accountability, Best Practices, education, Gimme Some Truth, Local News, National News

The basic idea behind “starve the beast” politics was expressed by Grover Norquist “”My goal is to cut government in half in twenty-five years, to get it down to the size where we can drown it in the bathtub.” What subtlety there is involves weakening the public sector to the point where it no longer functions as it should while building up the private sector. Eventually, even people who like the public sector in theory find themselves frustrated with the current state of affairs and withdraw support. The spiral goes from there, with less support the public sector gets weaker and weaker and weaker…. This is what is going on in Wisconsin.

The basic idea behind “starve the beast” politics was expressed by Grover Norquist “”My goal is to cut government in half in twenty-five years, to get it down to the size where we can drown it in the bathtub.” What subtlety there is involves weakening the public sector to the point where it no longer functions as it should while building up the private sector. Eventually, even people who like the public sector in theory find themselves frustrated with the current state of affairs and withdraw support. The spiral goes from there, with less support the public sector gets weaker and weaker and weaker…. This is what is going on in Wisconsin.

A story in the Racine Journal Times today captured the plan in action. The topic was the Committee on Joint Finance’s expansion — in funding, geography and income eligibility — of the private school voucher program. The larger context was that same committee’s cuts to public education totaling between $800 million to $1.3 billion (depending on how you count it). With at least one Racine parent, the plan is working.

Fabiola Diaz was glad to hear vouchers are moving forward. Diaz, 36, of Racine, has four children: One in a private high school, two in a Unified middle school and one too young for school.

She said she can barely afford to send her oldest child to the private school and would not be able to send her two middle schoolers to private high school without vouchers.

“I would really like all of them to have that opportunity,” said Diaz, an educator. “I don’t have anything against the school district, the public schools. It’s just that I feel with the budget cuts and things there’s going to be an even larger number of kids in the classrooms.

“In my experience, in a smaller school and smaller classroom my kids got more out of it and more attention from the teachers,” she said.

Such smaller class sizes should not be available only to families who can afford private school, Diaz said (emphasis added).

It sounds like she “gets it,” that she understands the opportunities all kids should have and sees that budget cuts have made it impossible for public schools to provide them. What’s a parent to do? Some of us fight to revitalize public education, to do our best to make sure that our kids and everybody’s kids have the opportunities to learn that they deserve. Others have given up, they’ll take their voucher and hope for the best. That’s the plan.

Thomas J. Mertz

Filed under "education finance", Best Practices, Budget, Equity, finance, Gimme Some Truth, Local News, Scott Walker