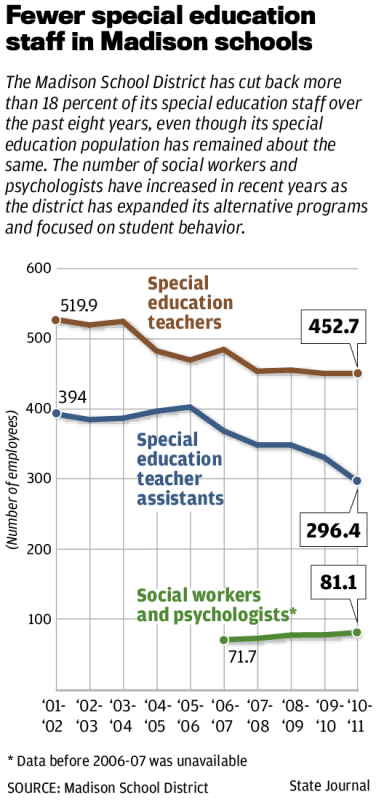

As has been the tradition this "On the Agenda Post" is illustrated with a graph highlighting inequalities in MMSD. This one is from the 2011 "State of the District Report" (click the image for the full report, this graph is on page 40 of the pdf). To be honest, I have no idea what it means. "Advanced Courses" are not defined anywhere, nor is the meaning of "rate." The graphs are accompanied by a factiod stating "The percentage of students taking advanced course in grades 9-12 increased in 2009-10 compared to the prior year from 13.7% to 15.2%." This and other graph show decreases -- see the ESL/Not ESL for the best example -- and the above graph also shows "rates "of about 50% (low income) and about 80% (not low income). The "rate" in the factiod may be the percentage of total courses taken that are "advanced" (whatever that means) and the graphs may be the percentage of students in each category who took at least one advanced course (or both maybe something else entirely, who knows?). As a presentation of data, this is incomprehensible and inexcusable.

I picked a bad week to start doing “On the Agenda” posts on the Madison Metropolitan School District Board of Education doings. Too much going on. Given the amount to cover, I’m going to try to keep the comments and context minimal. I should also note that I haven’t yet decided how regularly I will do these again.

The details for all of the meetings are here. Here is the rundown.

- 4K Advisory Committee, Monday, Monday, May 23, 9:00 AM, 5 Odana Court. The agenda is at “details for all” link, but none of the documents are linked.

- Special Board of Education Meeting in Closed Session, Monday, May 23 5:00 PM, Doyle Building, RM 103. The agenda is at “details for all” link, but none of the documents are linked, employee non-renewal and student discipline are listed.

- Regular Board of Education Meeting (Open Session), Monday, May 23 6:00 PM, Doyle Building, Auditorium. Agenda linked and discussed below.

- Madison School & Community Recreation (MSCR) Advisory Committee Meeting, Tuesday, May 24, 6:30 PM, MSCR Administration Building. The agenda is at “details for all” link, but none of the documents are linked. Some interesting things I’d like to see, especially the “2011-12 MSCR Budget Update” and “Draft 2010 MSCR Annual Report.”

- 2nd Annual Review of MMSD Strategic Plan, Wednesday, May 25, 5:00 PM, United Way of Dane County 2059 Atwood Avenue. The agenda is at “details for all” link, but none of the document linked here. There is a lot here. Way too much to absorb in any one session. What isn’t here is much in the way of an overall summary or summaries of each area or “Action Plan.” You have to go line-by-line to get a feeling of what is and is not going on with each action plan (I’ve made it about 1/3 of the way through). Since the “Action Teams” are — I believe — exclusively made up of staff, it means that no member of the public has been in the loop. Under these circumstances, a once year 86 page report-out followed by a feedback session isn’t going to produce much in the way of meaningful engagement. The Board realized some of this and established “Core Measures” (page 69). Of the 15 of 16 with goals, 8 have not been met; the 16th is the “Advanced Course Participation” graphed and critiqued at the top, there is no goal established for that. I should note that some of these benchmarks ramp up to ridiculous NCLB inspired 100% proficiency goals in the coming years. Failure is assured, eventually.

- Project Orange Thumb Garden Makeover Ribbon Cutting, Thursday May 26, 3:00 PM, Black Hawk Middle School 1402 Wyoming Way. A very positive school (Blackhawk), community (Community Action Coalition), business (Fiskars) partnership.

The rest of this is going to be about the Regular Board of Education Meeting (Open Session), the highlights ad lowlights, in order (unless a document is linked here, all the info available can be found at the link immediately above).

Election of Officers. Maya Cole and Beth Moss deserve thanks for their service as President and Vice President this past year. Whatever you think of their leadership, the jobs are difficult and time consuming, especially in a year like the one we’ve had.

PUBLIC APPEARANCES. Word on the street is that there will be a substantial turnout of teachers seeking the restoration autonomy in the use of Monday Early Release planning time that was recently lost in the under-the-gun contract negotiations. You can read more here and here. It seems to me that there is a combination of real concerns and symbolic politics in play on both sides. I don’t see the district rolling this back when they hold all the cards (thanks to Walker). I’d suggest a compromise that changes the mandatory activities from once a month to twice.

BOARD PRESIDENT’S ANNOUNCEMENTS AND REPORTS. Recognitions for accomplishments by students and staff and other feel good items like the project Orange Thumb garden.

SUPERINTENDENT’S ANNOUNCEMENTS AND REPORTS. Much meatier. Five is items, none starred for action at this meeting, but some may go forward without Board action.

Talented and Gifted Update and Recommendations (the Preliminary DPI Audit Findings and Administrative Recommendation to not contest are here).

Too much here for this post. I plan to get back to this in the coming weeks or months.

The price tag is an increase in the TAG budget from $1,123,249 to $1,725,880. This does not appear to include the $60,000 increase for Youth Options and the $70,000 for CogAT tests in the Superintendent’s (earlier) Recommendations. I’m not sure why not.

Both identification and follow through are problematic, both in practice and theory. One frightening revelation from the Preliminary Audit is that MMSD was “unable to provide a list of identified students.’ Think about that.

Anecdotally (and with TAG in MMSD, the lack of data is a big problem), I’ve talked to a handful of parents this year whose children scored in the highest identified grouping on one test or another without the referral process for identification being triggered. The DPI confirms that this has been hit-or-miss.

I remain skeptical on that there will ever be a rigorous and equitable identification process that covers “general intellectual, specific academic, leadership, creativity, and visual and performing arts.” I’d love to see the filings in a complaint based on the “leadership, creativity, and visual and performing arts” areas. I’m not saying give up — at least not here (for a provocative exploration of that idea, see James H. Boreland “Gifted Education Without Gifted Children The Case for No Conception of Giftedness“) — there is clearly room for improvement. I am saying there are some basic definitional and conceptual issues that are not going to go away. I’ve touched on these here; for more see Carol Fertig. “Conflicts in the Definition and Identification of Giftedness.”

Then there are all the questions about what follows identification…

One last observation is that the initial complaint centered on course offerings at West, that issue is only a small part of the DPI findings, has at least tentatively been settled via the changes enacted this year and is only addressed in a very indirect way in the Compliance Plan.

Superintendent’s Goals for 2011-12

I have to say that I was impressed (and somewhat surprised) by the degree to which the past goals had been achieved. Much more impressed here than with the Strategic Plan report. Maybe this is a function of the drafting and interpretation of the goals, but hats off to Supt. Nerad. I think that more specificity is needed going forward on some.

Reorganization of Public Information Department

Three quick thoughts. First, Joe Quick and the role of Legislative Liaison will be missed. I think this position was under-utilized recently, but valuable none-the-less. Second, Marcia Standford is an excellent choice for the Community Engagement work. Last, I like the realism reflected in the document in acknowledging that if you cut almost $200,000 from the budget and add new responsibilities, you can’t do everything you were doing before. “More with less,” works better in theory than in practice.

Badger Rock Contract Changes

Some small things clarifying BRMS terms fro withdrawing from the contract.

Additional 4K Sites

I had to read this one twice to believe it. It appears that in 2011-2012 MMSD will not be offering 4K at the MMSD Allied Drive Learning Center primarily because “Parents have raised concerns about their children being placed at the MMSD Allied Drive Learning Center for 4 programing, therefore some students (20) have been considered for transfers to other sites.”

Other reasons are given, but since Allied is still on the list for 2012-2013, they seem like window dressing to me.

MMSD could, say that the Allied kids — who have great needs and few options — should be given more consideration, they could say no to the transfer requests.

Instead they appear to be pandering to prejudice. What lesson is being taught here? How does that fit with the Mission Statement line about “embracing the full richness and diversity of our community.”

I haven’t followed this as closely as I should have. I know that the issue of location and access in relation to poverty was raised earlier (see this story by Matt DeFour), and that some reconsideration was promised. I’m not sure what happened next, but you can compare maps on the District 4K site (keeping in mind the latest developments).

I think that this is worth calling attention to and protesting.

Student Achievement and Performance Monitoring

K-12 Alignment

Standards and Test, the good and the bad. Mostly — but not all — the bad in my opinion (see these old posts for some of it and stay tuned for more).

Literacy Plan (Literacy Program Evaluation and Budget Requests, LITERACY RECOMMENDATIONS, LITERACY PROGRAM EVALUATION ANNUAL TASKS AND ACTIVITIES).

It looks like the cost is $611,000, most (all?) of which is covered in the earlier Superintendent Recommendations. One other note is that i don’t think meeting and records for the this group were posted regularly. When the Board approves the creation of a body that includes more than staff, this should be done as a matter of course.

Instructional Materials Purchase Plan

$415,000 more in purchases tied to the Literacy Plan. I don’t think this money is part of the costs above or the Superintendent’s Recommendations.

Operational Support

Prepayment of District Debt

I discussed this here (the Fund Balance, surplus material). My position is that some for escrow is good, but let’s spend to improve our district now.

March Financial Statements

All things considered, lo0ks good.

Madison Preparatory Academy for Young Men Future Direction regarding Funding Levels

Seeking some clarity on how MMSD’s contribution to the Madison Prep budget will be calculated and handled if this comes to fruition. Everyone needs to know how this would impact existing schools and programs and that isn’t clear, at all.

Proposed MMSD Energy Policy and Administrative Guidelines

Just what it says.

Plan for Use of Title I and Flow-Through American Recovery and Reinvestment Act (ARRA) Funds (IDEA-ARRA Funding Memo, Title I ARRA Budget Revisions memo, IDEA ARRA Funding Plan spreadsheets)

There have been a lot of changes in plans along the way, with money allocated, not spent and reallocated. Last year when a similar set of documents should about $7 million allocated, but not spent I made an informal bet with Erik Kass that they wouldn’t get it all spent by the deadlines. I think Erik is going to win.

Proposed Revisions to Board Policy 8005-Employment

It looks like some new language around consistency in interviews and follow-up questions.

CONSENT AGENDA

All the items with linked documentation are on the main agenda. Nothing jumped out at me.

Legislative Liaison Report

*1 Senate Bill #95—Mandate Relief

*2 State Budget Bill/Revised Revenue Projections/Save Our Schools Proposal

*3 Reauthorization of Elementary and Secondary Education Act

*4 School Voucher Proposals

*5 Children At Risk

I’ve written about SB 95 twice before (here and here). I’m not all that impressed with the “Save Our Schools” proposals which accede to at least $300 million in state aid cuts, do nothing about local control and generally accept the “we can’t afford to adequately fund education” paradigm.

The use of some of the increased revenue projections for schools is good, as is the shift of the Levy Credits from misdirected property tax relief to education. More on this later in the week.

The ESEA thing is interesting. It is from the national school administrator’s group and asks for full local flexibility in moving money among Title programs. I don’t like it. the regulations may be unduly cumbersome, but I don’t trust many local officials to not divert money for kids i poverty to other uses.

I don’t see anything on the Children at Risk Program or the Voucher legislation here. Vouchers, yech.

Thomas J. Mertz

There is an editorial in the Herald Times Reporter on the Two Rivers school budget that presents contradictory ideas and ultimately makes no sense. If you dig a little deeper, you’ll find more that doesn’t make sense.

There is an editorial in the Herald Times Reporter on the Two Rivers school budget that presents contradictory ideas and ultimately makes no sense. If you dig a little deeper, you’ll find more that doesn’t make sense.